Understanding the Bond Market — The Hidden Driver of Everything You Trade

Key Takeaways

- Bond yields drive asset prices: rising yields hit equities and crypto, while low yields fuel risk-taking.

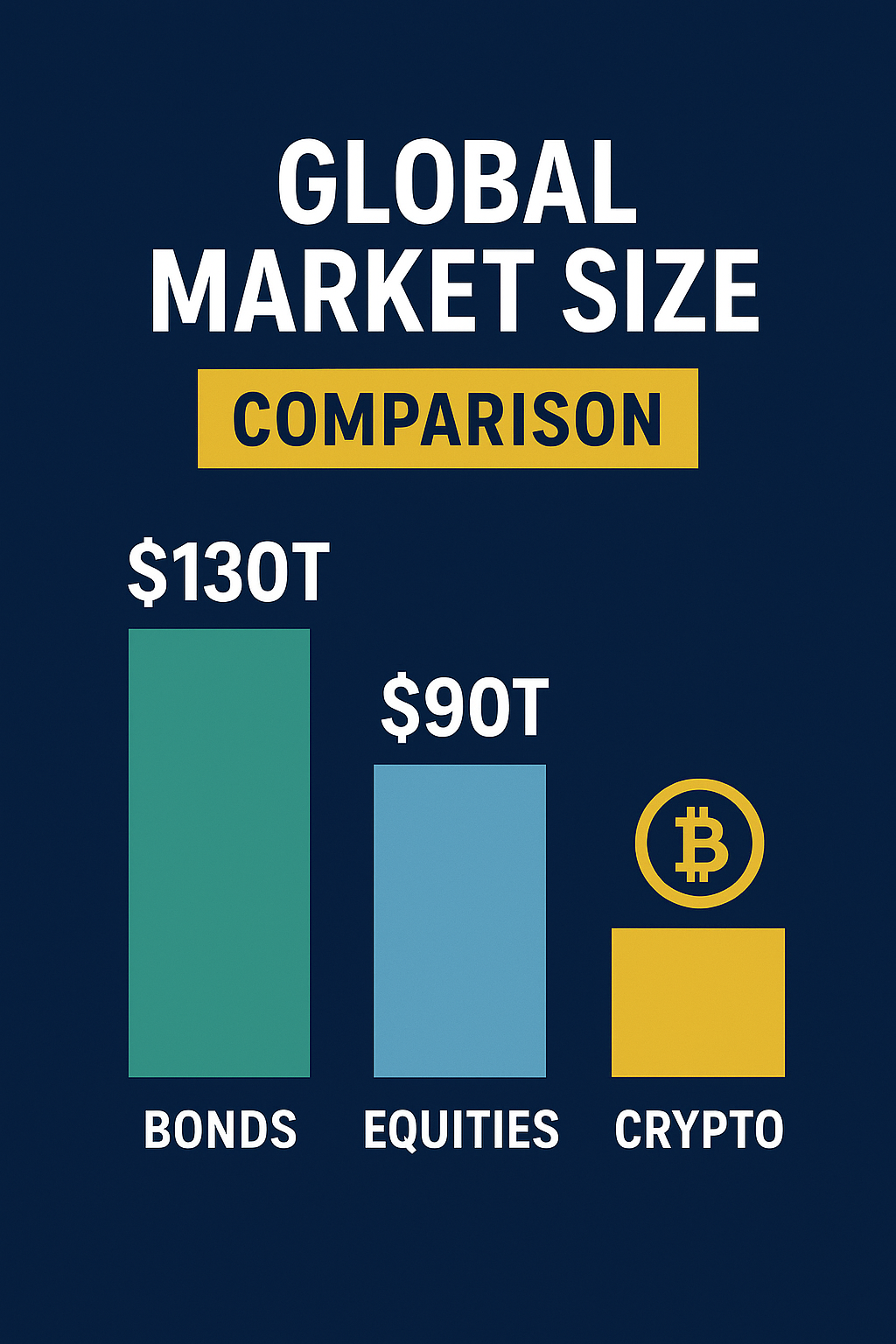

- The bond market’s $130 trillion size and liquidity make it the benchmark for global finance, including mortgage rates.

- The 2025 shutdown’s uncertainty is pushing Treasury yields up, signaling volatility across markets

What this short guide is for

A compact, no-fluff primer that gets you from “what are bonds?” to understanding how they move every other market — stocks, gold, crypto, and housing. This is educational only, not financial advice.

Who this is for

Traders, investors, and market enthusiasts who want to grasp why yields move markets — and how to read those moves for smarter decisions across assets.

Why the Bond Market Matters

The bond market is the titan of global finance — worth over $130 trillion in 2025, larger than the entire global stock market combined. It’s where governments, companies, and institutions borrow money — and where the real heartbeat of global liquidity lies.

Think of bonds as the foundation:

When yields change, everything else — stocks, gold, crypto, even your mortgage — shifts in response.

Key reasons bonds dominate

Size & Liquidity: U.S. Treasuries trade in massive volume — the deepest, most liquid market on Earth.

Benchmark for Risk: Treasury yields form the “risk-free” rate that prices every other asset.

Economic Signal: Bond yields reveal how investors view inflation, growth, and Fed policy.

What Bonds Are (in Plain English)

A bond is a loan — you lend money to a government or corporation, and they pay you interest (the coupon) until the bond matures, when your principal is returned.

Main types of bonds

Government Bonds: U.S. Treasuries, UK Gilts, German Bunds — safest and most liquid.

Corporate Bonds: Issued by companies — higher yield, higher risk.

Municipal Bonds: Issued by local governments — often tax-advantaged.

When you hear “the bond market,” it’s the massive web of investors buying, selling, and pricing these debt instruments worldwide.

How Bond Yields Work

Bond prices and yields move inversely:

When prices go up → yields go down, and vice versa.

Example:

If demand for bonds surges (investors seeking safety), prices rise and yields fall.

If investors sell bonds (expecting rate hikes), prices fall and yields rise.

2025 Snapshot

10-Year Treasury Yield: ≈ 4.02%

2-Year Treasury Yield: ≈ 4.32%

→ The yield curve remains inverted (short-term yields > long-term) — often a recession signal.

How Bonds Shape Every Market

1. Bonds & Stocks: The Balancing Act

Rising yields = higher borrowing costs → lower corporate profits → stocks weaken.

Falling yields = cheaper money → stocks rally.

Rule of thumb: When the 10-year yield climbs toward 5%, tech and growth stocks usually wobble.

2. Bonds & Gold: The Safe-Haven Rivalry

Gold doesn’t pay interest — so when yields rise, investors prefer bonds.

But when yields fall (or real yields turn negative), gold shines.

💡 Watch real yields:

If inflation > nominal yields → gold often rallies.

3. Bonds & Crypto: Risk-On vs. Risk-Off

Low yields = cheap money → crypto booms.

High yields = tight liquidity → crypto cools off.

Bitcoin’s major corrections often follow yield spikes above 4%.

4. Bonds & Mortgages: The Direct Link

Mortgage rates mirror 10-year Treasury yields.

In late 2025, 10Y ≈ 4.0% → average 30-year mortgage ≈ 7.3%.

Rising yields = weaker housing market and slower consumer spending.

How to Read Bond Signals

10-Year Yield (Benchmark)

Above 5% → markets tightening

Below 3.5% → easing expectations

Yield Curve (10Y–2Y Spread)

Inverted (<0) → recession risk

Steepening (>0) → growth expectations

TIPS Spread (Inflation Expectations)

Rising spread = inflation fears

Falling spread = disinflation

Pro Tip: Before any trading day, glance at DXY, 10Y yield, and yield curve direction — they tell you where risk sentiment is heading.

Trading & Investment Insights

Stocks: Favor defensive sectors when yields rise.

Gold: Track real yields for timing entries.

Crypto: Watch for yield curve steepening — early liquidity return.

Forex: Higher U.S. yields strengthen USD, pressuring EUR/USD and gold.

Example:

When the Fed paused rate hikes in mid-2023, the 10Y yield dropped 40 bps → S&P 500 rallied 5% → Gold jumped $60 → Bitcoin rebounded 10%.

Risk Management & Common Mistakes

Ignoring yields when trading macro assets.

Overreacting to headlines instead of yield trend.

Assuming all yield spikes are bearish — context matters.

Forgetting that central banks, not traders, set the tone for yields.

⚠️ Always align trades with yield direction, not emotion.

What the Current Bond Market Says (Late 2025)

The U.S. yield curve remains inverted, signaling potential slowdown.

10Y near 4.0% = markets expect stable but not explosive growth.

The ongoing government shutdown adds volatility — short-term yields rising as liquidity tightens.

Section 7 — Conclusion

The bond market isn’t just another asset class — it’s the heartbeat of global finance. Every move in stocks, gold, crypto, and real estate eventually traces back to yields.

Learning to read the bond market is like learning to read the wind — invisible, but decisive. Once you understand how yields breathe, you see what most traders miss.